During the other three declining periods after 2009, EPS growth declines were modest-to-moderately deep. Earnings were very deeply cyclical in 2009, falling -82% off their highs, but they did stay positive. The dark green shaded area in the FAST Graph above represents NVIDIA's historical earnings per share. The reason I do this is because I want to know if this is a stock that fits the profile of a stock I would consider investing in, and also I want to know which strategy and techniques are the most appropriate to analyze the stock in question. The first thing I check for every stock I analyze is to see what its historical earnings cyclicality looks like.

Now that NVIDIA is trading down a little bit, my hope is I'll have a more receptive audience.

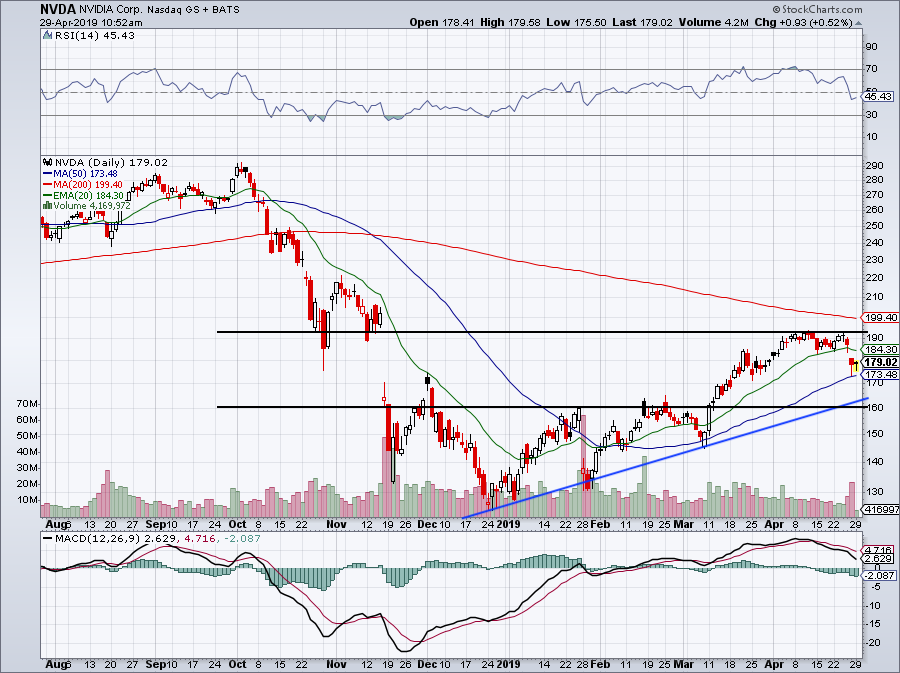

Readers seem less likely to pay any attention to my warnings and expectations until the start of a decline. I have an atypical investing approach when it comes to stocks like NVIDIA, and while I do occasionally write warning articles when these stocks get really overvalued (as NVIDIA was last year) I find that readers are more receptive to my investing style after the stock price has fallen a bit off its highs. I also happen to think this particular downturn we are headed into is probably going to offer a very good buying opportunity for semiconductor-related stocks generally, and now is the time to develop a plan for when to buy them if you haven't already. But I have successfully invested in other semiconductor stocks like Micron ( MU) and Microchip Technology ( MCHP) and written about them publicly. I've never written on NVIDIA before, mostly because I didn't start writing full-time about investing until 2018, I like to buy stocks when they are very cheap, and NVIDIA has never been very cheap during the past five years. Most of those folks are severely underwater right now. That is unless they bought the stock during the past two years. NVIDIA has without a doubt made a lot of investors rich. It's difficult to find a stock from the late 1990s that has returned over 35K%. (BlackRock ( BLK ) is the other, if you are curious.) Data by YCharts There are two exceptions to this dismal trend that I'm aware of, and NVIDIA ( NASDAQ: NVDA ) is one of them. Most of the rest have never recovered the stock prices achieved at their IPOs or soon after. They either crashed and were bought out at very low prices, or they went bankrupt. The vast majority of stocks that went public that year are no longer around. Anilakkus/iStock via Getty Images Introductionġ999 was not a great year to be buying initial public offerings in the stock market.

0 kommentar(er)

0 kommentar(er)